Buy My House Fast, Cash Buyers in AZ

Buy My House Fast for Cash

You’ve probably seen signs like these at the side of the 101 in Scottsdale and Phoenix Arizona, stapled to a telephone pole in East Mesa: “We Pay Cash For Houses.” Maybe you’re also aware of iBuyers, algorithm-driven companies that offer cash for houses and close on the deal within days. Should you, as the property owner trying to sell a house quickly, pay attention to these businesses? What are their business models?

First, Some Background Information

The business of investors buying homes for cash is a big deal. According to the National Association of Realtors, since March of 2020, approximately 21% of residential home sales have been cash-only transactions. Of these, investor purchases accounted for 13%.

Selling your property to investors for cash is similar to trading your car in at a dealership. Nothing prevents you from selling your car yourself. You can take care of the minor repairs, place an ad and meet potential buyers for test drives. But it may simply be easier for you to trade your car in at the dealership and let the dealer worry about repairs, advertising and test drives.

Who Pays Cash For Houses?

Not all buyers in this category will have the same policies, however. Cash home purchasers can be divided into three categories:

1. Buy-and-Hold Investors

These cash buyers buy your home, then turn it into a rental property. They earn back their investment through the passive income of collecting rent.

In the first quarter of 2020, 1.9% of condo and single-family homes were sold to this type of large-scale investor. If you sell your home to a buy-and-hold investor, you may get a better price than you would by selling to a house flipper, but the closing date will not be more flexible.

2. House Flippers

These are people who buy homes that need a significant amount of remodeling when the cost is low, then renovate them and sell them for a profit. These homes are bought “as-is” According to ATTOM Data Solutions, in 2018 there were 207,957 flipped homes, accounting for 5.6% of condo and single-family home sales.

3. iBuyers

iBuyer is shorthand for “instant buyer.” These technology-savvy investors use AVMs (automated valuation models) to put in competitive offers on single-family homes that are generally in better condition than the houses targeted by flippers. iBuyers generally expect to make less profit than a house flipper, so their business model depends upon streamlining the process with technology and selling a large volume of houses.

The home seller still doesn’t have to deal with staging and showing the home and can close the sale in only a few days after agreeing to an offer. An iBuyer will generally offer the seller up to 98% of the home’s fair market value, subtracting 7%-10% for a fee and the cost of any critical repairs.

In Phoenix, Arizona, iBuyers accounted for 6% of market share in 2018, which represented a 26% increase from the previous year. Approximately 30% of home sellers in Phoenix asked their real estate agent for an estimate from an iBuyer before putting their houses up for sale.

7 Things to Know Before Agreeing to a Cash Home Buyer

-

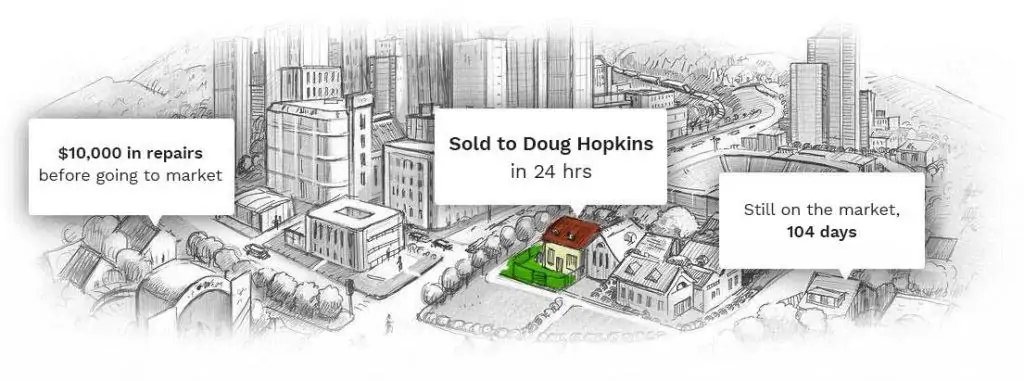

- Doug Hopkins will offer you a cash buyout quickly for your house.In 2018, 91% of all homeowners listed their houses with real estate agents. For sellers whose priority is getting the highest selling price possible, this is generally the right step. Real estate agents provide services such as helping get the prepared and staged that in turn help the homeowner get a fair price. Agents also guide the seller through price negotiations and the closing.For homeowners whose priority is selling the home quickly rather than getting the best price, a cash buyer like Doug Hopkins might be an attractive option.

Some iBuyers Will Purchase a House As-Is.

-

- If your house needs major repairs and renovation before you can sell it on the market, cash offers may seem tempting if the cash buyers are willing to buy the house in an as-is condition. Every potential buyer has their own set of criteria and terms on the kind of house they would be willing to purchase, its condition and the price.House flippers look specifically for distressed properties that can be rehabilitated for a profit. On the other hand, iBuyers look for homes that in fairly livable to poor condition, with only cosmetic and minor repair issues that will sell for a competitive price. iBuyers will send their home inspectors in to inspect the home and sometimes subtract the cost of any urgent repairs from the sale price.Whether the potential buyer arranges for necessary repairs or agrees to buy the house as-is, the homeowner won’t have to go through the hassles of completing the repairs or the expense of contracting them out.

The Homeowner Can Avoid Contingency Clauses

-

- Contingencies, or “back out” clauses, are a common part of house sale contracts. They’re intended to protect buyers, but in some cases, they can become onerous for the seller. Clauses of a contingency clause might read something like this:• Even if the offer is approved by the bank, it remains valid only if the mortgage lender upholds the terms.• Offer only remains valid if the buyer’s current residence sells in a time frame of three months.

• Offer is contingent on the home inspection not uncovering any major necessary repairs.Contingency clauses are one obstacle the home seller can avoid by agreeing to a cash sale on the property with an investor. Note that many cash buyers will still require a home inspection.

- Contingencies, or “back out” clauses, are a common part of house sale contracts. They’re intended to protect buyers, but in some cases, they can become onerous for the seller. Clauses of a contingency clause might read something like this:• Even if the offer is approved by the bank, it remains valid only if the mortgage lender upholds the terms.• Offer only remains valid if the buyer’s current residence sells in a time frame of three months.

Financing Works Differently – In a Good Way

-

- Home sales traditionally take so long to close because of the involvement of banks. The buyer may have to borrow money, and the bank’s timeline will not depend upon the buyer’s timeline or the seller’s timeline. Since no lenders are involved in a cash-only transaction, cash purchases can typically close quickly.Home sales may also fall through when the financing fails to come through. A cash sale is a means to skipping this potential pitfall.

A Cash-Only Home Sale Is Not Only Quicker But Also Less Legwork

-

- Once you’re matched with an interested potential buyer, you can skip prepping and staging your home. You don’t have to worry about photographing every room in the best light or coming up with words to describe all of your house’s features and amenities.Cash buyers can set up the home inspection and take care of the repair decisions for you. You can also skip the lending steps completely. All you have to do is call the investor or home buying company. They’ll ask you a few questions and make you an offer. From there, all you have to do is decide to take the offer or leave it. If you take the offer, closing can happen within one to two weeks.For buyers who’ve had a sudden change in their lives – a new job in a different state, for example – the swiftness and ease of the cash buying process makes it an attractive option.

Renting Out or Selling Your Home with an Agent’s Help Is Another Option

-

- Some of the other options for a homeowner who’s thinking about selling the house for cash include selling it on the home buyers’ market or renting it out. If the home is still in livable shape, rental may be an option. This requires you to contract with a property management company if you’re unable to keep up with repairs and routine maintenance yourself. However, in many cities rental costs are higher than mortgage costs, so a rental tenant may be able to pay the house’s mortgage payments for you. If you find a good tenant, you might even consider offering them a lease-to-own option.You find a real estate agent who has a consistent record of selling and buying homes quickly like Doug Hopkins.

Beware of Sell Your House for Cash Scams

- If you’re in the market to sell a home quickly due to an averse life circumstance like a death in the family, divorce, disclosure or bankruptcy, a no-frills cash transaction may seem especially enticing. This doesn’t mean you can skip doing your background research.Unlike real estate agents, investors can operate without licensing. Many cash-for-houses investment companies are legitimate, but the industry still contains its fair share of scammers.Keep your guard up. Look over your credit history report to make sure no one took out an unauthorized second mortgage on your home without your knowledge. Beware of any alleged cash-for-houses investors that ask for an up-front application fee. Less known home buying companies can steal your equity and disappear, leaving you even worse off than you were before you started looking into a cash sale for your house.If your time is short and you don’t have the energy to do all your due diligence, you would be further ahead going through getting a cash offer to “buy my house” from Doug Hopkins in any of the cities of Arizona including Scottsdale, Mesa, Glendale, Phoenix, Gilbert, Tempe and Avondale AZ.

What’s the business model for cash-for-houses businesses?

By selling your home in a cash transaction, you can close on the offer within a week or two and skip staging, showing and sometimes repairs your house.

What’s the best option for the homeowner?

For homeowners whose top priority is selling the property fast, you can get an almost instant online offer to sell your house at www.DougHopkins.com

But what’s the catch, though?

The catch is that the homeowner has to have a little bit of background knowledge, do a little investigation and be vigilant if you need some one to buy my house for cash. A cash buyer is the right option for some sellers.