Downtown Phoenix Arizona

Phoenix Arizona Foreclosure Statistics 2022-2021

In early 2023-2022, foreclosure rates were slowing down nationwide. However, by July, rates began to trend up again, with some cities in Florida and California experiencing more than a 20% increase in foreclosure rates

Risky Money

The recent relaxation of financial regulations has brought more uncertainty to the housing market. While low interest rates have decreased the urgency of buyers to quickly find a home to purchase, easier mortgage qualifications have put lenders at greater risk of issuing risky loans.

Homeowners have also faced additional challenges, such as the aftermath of natural disasters. For instance, Houston, Miami, Los Angeles, and even Phoenix Arizona have experienced a surge in foreclosure rates in mid-2018, as reported by Doug Hopkins Realty.

Better Than 2021, Much Better Than 2010

In 2021, foreclosure rates were lower in most states and metropolitan areas across the US. Furthermore, properties that are foreclosed are spending less time in legal limbo than before. Banks are taking quicker action to take control of properties from buyers who can’t pay, and this trend suggests that buyers interested in foreclosed properties are more eager to purchase them.

Was The Summer Dip An Anomaly?

Early 2021 started out quite rosy in the housing forecast. In fact, the foreclosure rate for the first quarter of 2022 was down 19% from the first quarter of 2017.

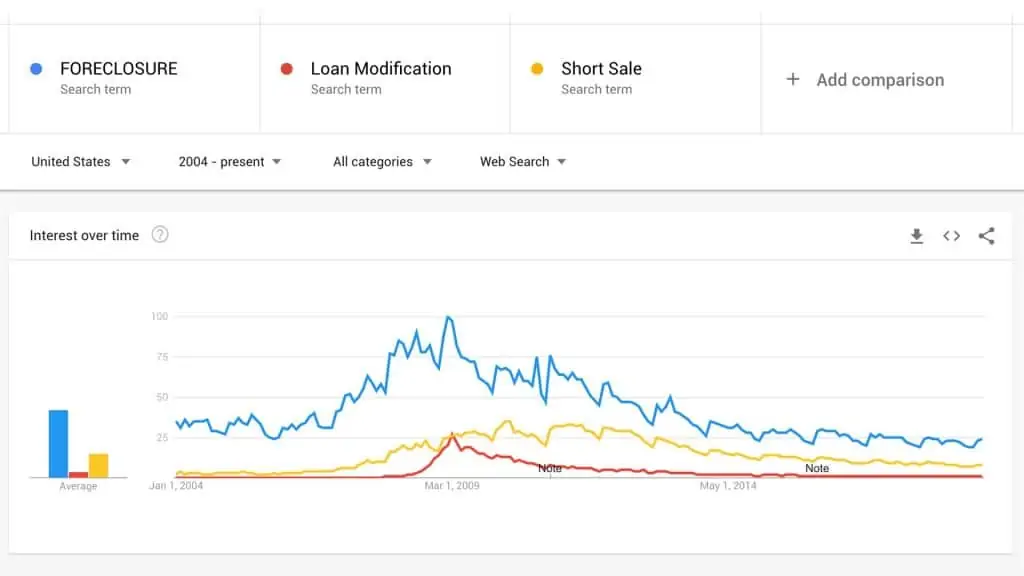

Part of the change in foreclosure rates can be tied back to the crash of 2007-2008. Up until calendar year 2018, half of the mortgages going into foreclosure were originated between 2004 and 2008. The financial free-for-all (and subsequent free-fall) triggered by poor loan decisions appeared to be clearing in 1st quarter 2018.

As the nation of homebuyers crosses from pre-recession to post-recession loans and lending requirements, we had hopes of a more stable housing market.

USA Foreclosure Facts 2022-2021

A Grim October Bump

In October 2018, foreclosure rates experienced a significant surge. The increasing trend in foreclosures that began during the summer continued and reached a rate of 21% by October 2021. Several states were hit particularly hard during this ramp-up period, including Nevada, Phoenix, California, and Texas. In addition, other states that saw a year-over-year increase in foreclosures include New York, Pennsylvania, Florida, and Alabama.

- Nevada

- Phoenix

- California

- Texas

Price Bumps Don’t Help

Prospective homebuyers are encountering multiple challenges in the current real estate market, including higher sale prices and an increase in foreclosures. Despite the rise in mortgage interest rates, access to financing remains limited. The western U.S. has been hit particularly hard, with a decrease of nearly 9% from last month in pending home sales rates from the previous month and over 15% from the same time last year.

First-time homebuyers are especially affected by the current market conditions, with many being priced out of the market due to elevated home prices and higher interest rates. Rates for a 30-year mortgage are currently around 5%, making it difficult for those seeking their first home purchase. The rental market is also challenging, with tighter markets, high rental rates, and limited space options adding to the difficulties for renters.

Cities In Crisis

According to experts, it seems that the mortgage market is no longer susceptible to the impact of poor real estate investment loans granted before 2008, particularly during the bubble years of 2004 to 2008. Instead, current foreclosure data suggests that there are three main factors that contribute to the challenges faced by homebuyers in fulfilling their real estate investment loans. These include high prices, which increase the pressure on buyers to allocate a larger portion of their income towards monthly payments, employment risks caused by significant layoffs or a collapse in the job market, and natural disasters.

Houston provides a clear example of the impact of three basic triggers , with the city facing a 76% increase in foreclosure rates compared to last year. The aftermath of Hurricane Harvey demonstrates the extent of the damage that can be left behind, both to housing stock and the necessary infrastructure required to access places of employment.

Final Thoughts

Regrettably, it appears that interest rates will remain high for the foreseeable future. As a result, prospective homebuyers must brace themselves for the challenge of having to provide a more significant down payment and accommodate larger monthly mortgage payments, as well as understanding that the process of selling their house may take longer. This poses a particular risk for those looking to sell their first home and expand into a larger property. Although days on market trends may be decreasing nationwide, many sellers may find themselves unable to sell their starter home.

Foreclosure Statistics 2020-2019

During the mid-2000s, the sub-prime mortgage industry issued millions of sub-prime mortgages, leading to a surge in the demand for housing and subsequently increasing the median home value. However, the situation changed as interest rates rose, and adjustable-rate mortgages reset, leaving millions of people with unaffordable mortgage payments and underwater balances. This led to a higher demand from Americans looking to sell house fast to cash investors.

This activity in the mid-2000s had a significant impact on the foreclosure rate in the United States. Though foreclosure rates have declined, people following the housing market and overall economy should remain vigilant to changing trends. In 2017, it is crucial to be aware of several foreclosure statistics t.

May Sees Increases In Foreclosures

In May 2017, the number of homes in the foreclosure process increased by 5% compared to the previous month. This resulted in a total of 647,000 homes in some stage of foreclosure, including bank-owned, defaulted, or in the auction process. Despite the increase in May, foreclosure rates are still down over 20% compared to May 2016.

Another notable trend is that the median list price for homes has risen, while the discount on foreclosed properties has declined. In May 2017, the median list price was $230,000, with a median sales price of $215,000, resulting in a 6.5% discount compared to the previous year’s 8%. Additionally, while the median home price in the US has increased by 4% YoY, the median price of foreclosed properties has increased by 6%, indicating higher demand from investors.

Foreclosure rates vary across the country, with states like New Jersey, Delaware, and Maryland experiencing higher concentrations of foreclosures compared to others. Improved credit availability has also contributed to the increase in foreclosed property prices.

Despite current low foreclosure rates, market experts predict that this trend may continue to rise in the future due to several factors such as increasing interest rates, stagnant wages, and higher costs of living, making affordability more challenging.